Top 5 AI Investing Apps in 2025 (Invest from $1)

Alice

June 17, 2025 · 11 min read

I get it.

You’ve probably seen those flashy TikToks or Instagram reels showing off how AI investing apps can manage your portfolio, pick winning stocks, and even trade while you sleep...

But with so many apps promising to “make investing easy,” how do you actually choose the right one?

Just a few months ago, I was in the same spot. I wanted to grow my savings but didn’t have time to become a full-time trader—or the budget to hire a financial advisor. That’s when I discovered a handful of AI investing apps that didn’t just simplify the process, they automated it. Today, I’ve built a solid portfolio, learned more about investing than I ever expected, and it all started with just $1 and an AI-driven investment app.

If you’re curious about which AI investing apps are actually worth your time—and how they can help beginners and pros alike—this guide is for you.

TL;DR: I’ll walk you through what AI investing apps are, how they work, and why apps like RockFlow, Betterment, and Acorns are leading the pack in making investing smarter and more accessible than ever. These are the top AI investing apps for 2025, whether you're searching for the best AI investment app, an AI investing app for beginners, or a tool to help you invest from just $1.

The top 5 AI investing apps for 2025—RockFlow, Betterment, Acorns, eToro, and Plum—stand out for their innovative features and accessibility. Each app leverages AI to simplify investing, offering tools like personalized insights, automated savings, and social trading. These platforms empower users to make informed decisions, even with minimal experience or capital.

Top 5 AI Investing Apps in 2025

RockFlow: The Best AI Investing App for Beginners

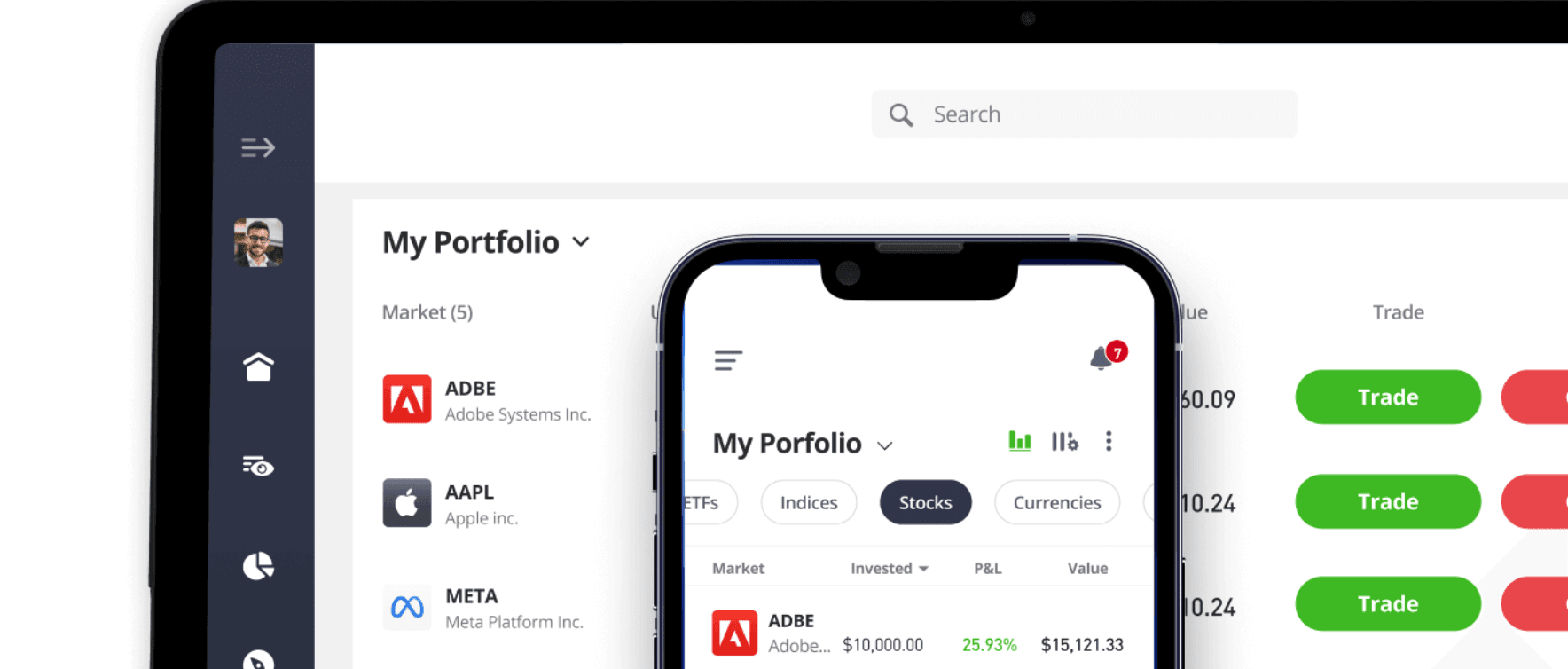

RockFlow stands out as an ideal choice for novice investors and is widely considered one of the best AI investing apps for beginners in 2025. This AI-driven platform simplifies the investment process, making it accessible to users with minimal experience. Its flagship feature, AI Strategy, leverages advanced algorithms to provide daily trading opportunities. By analyzing market trends and quantitative data, AI Strategy offers personalized insights that help users make informed decisions.

One of RockFlow's most appealing features is its low entry barrier. Users can start investing with just $1 and purchase fractional shares of major companies like Apple and Tesla. This approach democratizes investing, allowing beginners to diversify their portfolios without significant capital. Additionally, the CopyTrading feature enables users to replicate the strategies of top traders, offering a passive income stream while learning from experienced investors.

RockFlow also prioritizes user experience. Its sleek interface, multilingual support, and curated stock lists, such as "Gen Z's Picks," cater to a diverse audience. These elements, combined with robust security measures and regulatory compliance, makes RockFlow not just beginner-friendly, but a leading option for anyone exploring the most AI-driven investment apps on the market.

Tip: RockFlow's engaging community features, like NFT avatars and themed stock lists, make investing both fun and educational for younger users.

Betterment: One of the Best AI Investment Apps for Simplicity & Tax Optimization

Betterment excels in providing streamlined portfolio management through AI. This platform tailors investment strategies to individual needs, ensuring that users achieve their financial goals efficiently. Its approach emphasizes five key principles: personalized planning, built-in discipline, diversification, cost-value balance, and effective tax management.

Betterment's AI tools analyze market indicators and relationships, enabling users to make data-driven decisions. By assessing individual risk tolerance, the platform suggests suitable assets, enhancing the personalization of investment strategies. These features make Betterment a top choice for investors seeking simplicity and efficiency in portfolio management.

Note: Betterment's disciplined approach to investing helps users stay on track, even during volatile market conditions.

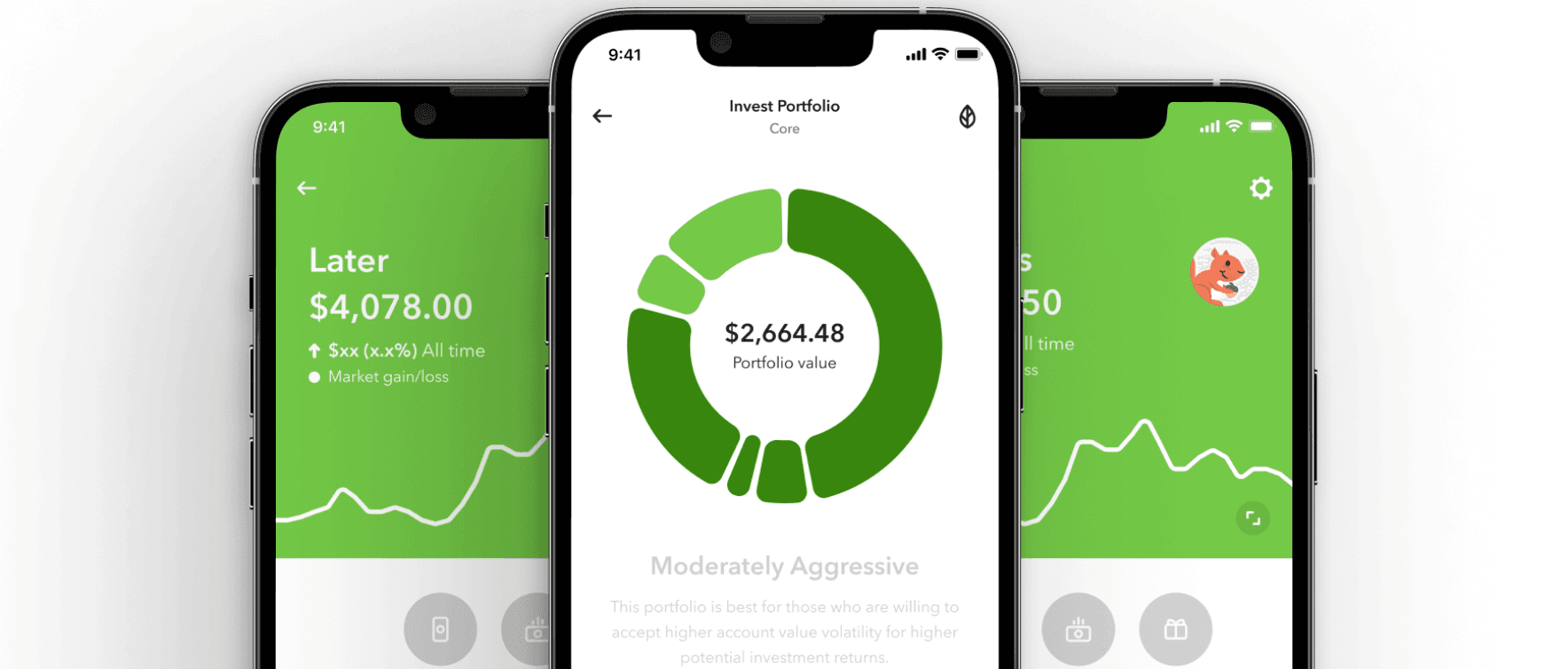

Acorns: A Top AI Investing App for Micro-Investing Beginners

Acorns revolutionizes micro-investing by combining automation with AI insights. The platform simplifies the investment process by rounding up everyday purchases to the nearest dollar and allocating the spare change into diversified portfolios. This approach makes investing effortless, especially for those new to the financial world.

Acorns revolutionizes micro-investing by combining automation with AI insights. The platform simplifies the investment process by rounding up everyday purchases to the nearest dollar and allocating the spare change into diversified portfolios. This approach makes investing effortless, especially for those new to the financial world.

Acorns uses AI algorithms to analyze spending habits and optimize fund allocation. It offers tailored portfolios, such as "Grow" for wealth building and "Later" for retirement planning. The Family Account option allows users to invest in their children's futures, making it a versatile tool for long-term financial planning.

The mobile app ensures seamless integration, enabling users to manage their investments on the go. Acorns also provides educational resources to help novice investors understand the basics of investing and personal finance. These features enhance user engagement and make Acorns one of the best investment apps for micro-investing in 2025.

Tip: Acorns' automation and educational tools empower users to build wealth gradually, making it an excellent choice for those with limited time or experience.

eToro: Social Trading Meets AI-Driven Investing Tools

eToro has redefined the way people invest by combining social trading with advanced AI insights. This platform allows users to connect with a global community of investors, making it one of the most interactive investment apps available. Through its CopyTrader feature, users can replicate the strategies of successful traders, gaining valuable insights while building their portfolios. This feature is particularly beneficial for beginners who want to learn from experienced investors.

AI plays a crucial role in eToro's success. The platform uses machine learning algorithms to analyze market trends and provide real-time insights. These tools help users make informed decisions by identifying profitable opportunities and minimizing risks. eToro also offers a wide range of assets, including stocks, cryptocurrencies, and ETFs, ensuring that users can diversify their investments effectively.

The platform's user-friendly interface makes it accessible to investors of all experience levels. eToro's AI tools simplify complex data, presenting it in a way that is easy to understand. This approach empowers users to take control of their financial futures, making eToro one of the best AI investing apps in 2025.

Tip: eToro's social trading features are ideal for those who want to learn from others while leveraging AI to enhance their investment strategies.

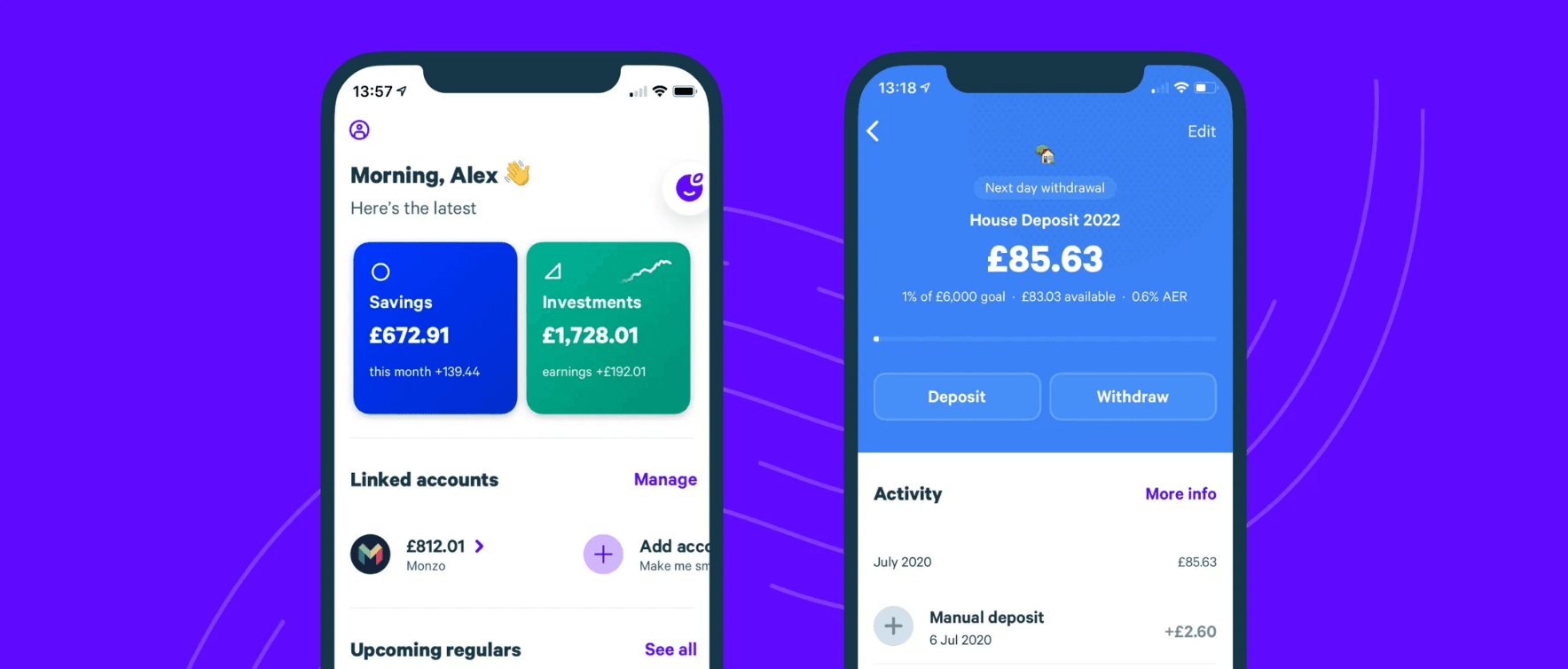

Plum: Smart Automation with AI Investment Features

Plum is an AI investment app that simplifies saving and investing, stands out as an automated investing app that simplifies saving and investing through AI. This platform uses artificial intelligence to analyze spending habits and provide personalized savings recommendations. By automatically calculating and transferring spare change, Plum ensures that users save consistently without manual effort.

The app's AI-driven features optimize savings and investment decisions. For example, Plum identifies opportunities to save based on a user's financial behavior and allocates funds to tailored investment portfolios. These portfolios cater to different goals, such as wealth building or retirement planning, making Plum a versatile tool for long-term financial success.

Plum's commitment to user experience has also contributed to its popularity. A recent redesign improved transaction success rates by reducing user confusion, ensuring a seamless experience for all users. The platform's ability to combine automation with personalization makes it one of the best investment apps for those seeking efficiency and simplicity.

Plum's AI capabilities make it an excellent choice for individuals who want to automate their savings and investments. By eliminating the need for constant monitoring, this robo-advisor allows users to focus on their financial goals with minimal effort.

Note: Plum's ability to combine automation with AI insights makes it a top choice for those looking to simplify their financial planning.

Benefits of Starting with $1

How Low-Cost Investing Empowers Beginners

Starting with just $1 makes investing accessible to everyone, regardless of their financial background. AI-driven platforms have revolutionized this approach by offering tools that simplify decision-making and risk management. These platforms analyze vast amounts of data to create personalized investment plans, ensuring that even small investments are optimized for growth.

- AI tools provide real-time data processing and predictive models, enabling users to make informed decisions.

- Research shows that AI-driven platforms can outperform traditional methods by 20% over five years.

- The growing demand for efficient financial tools highlights the potential of starting small while leveraging advanced AI capabilities.

By lowering the entry barrier, these platforms empower beginners to take their first steps toward financial independence. They also encourage users to explore investment opportunities without the fear of losing significant capital.

Building Confidence Through Small Investments

Small investments help new investors build confidence in their financial decisions. Research indicates that receiving more information, even in small increments, boosts confidence in predictions. For instance, a study on horse racing found that participants felt more assured in their forecasts as they received additional data, even if accuracy did not improve significantly.

This principle applies to investing as well. Starting with $1 allows users to experiment with different strategies and learn from their experiences without significant financial risk. Over time, these small steps foster a sense of control and competence, encouraging users to invest more confidently.

Tip: Consistent small investments can lead to significant growth over time, especially when combined with AI-driven insights.

The Role of AI in Making Micro-Investing Effective

AI plays a crucial role in enhancing the effectiveness of micro-investing. It analyzes individual risk tolerance, investment goals, and market conditions to determine optimal investment allocations. This ensures that even minimal contributions are strategically utilized.

AI also processes news, social media, and market data to gauge sentiment and predict movements, making it an indispensable tool for micro-investors. By automating complex tasks, AI ensures that users can focus on their financial goals without being overwhelmed by technical details.

Note: The combination of AI and micro-investing allows users to maximize returns while minimizing effort, making it a cornerstone of the best low-cost trading app strategies.

Thanks for reading all the way through! I hope this gave you a clearer picture of what AI investing apps can actually do—and how they can fit into your financial journey.

If you’re just getting started or want an easy way to automate your investments, RockFlow is a great option to explore. It’s affordable, beginner-friendly, and packed with smart features that make managing your portfolio feel effortless.

At the end of the day, the best AI investing app depends on your personal goals, budget, and how hands-on you want to be. I always recommend trying a few and seeing which one matches your style. But if you're looking for a solid place to start, RockFlow is definitely worth a test drive.

Let me know if you end up trying one—I’d love to hear what worked for you!

Related Content