Top AI Investing Apps in 2025 – We Tried Them All So You Don’t Have To

RockFlow Shayne

July 15, 2025 · 8 min read

The rise of AI is transforming how we invest. Gone are the days of spreadsheet tinkering and endless YouTube videos. Today, a new breed of AI investing apps and AI trading tools promises smarter, faster, and more personalized investment advice — even full execution — at your fingertips.

But with so many new tools emerging, how do you know which AI invest tool actually works?

We tried them all: from Bobby, the conversational AI agent fully integrated into RockFlow, to Q&A bots like Incite AI, and quant-heavy systems like Tickeron. Here’s what we found.

Our Picks: Best AI Investing Apps for 2025

| Rank | Tool | Best For | Core Strength |

|---|---|---|---|

| 1 | Bobby | Smart, seamless investing + trading | Human-like AI agent + in-app trading |

| 2 | Magnifi | Account analysis for beginners | Links with brokers for simple AI portfolios |

| 3 | Tickeron | Active quant traders | Signal-based, rule-driven quant trading |

| 4 | Incite AI | Casual investors & learners | AI Q&A for stock screening & learning |

| 5 | AlgosOne | Strategy builders | Deep custom algo setups |

| 6 | Koinly | Crypto-focused investors | AI-assisted tax reporting for crypto |

| 7 | Futu (Moomoo) | Traders with light AI use | Great mobile app + watchlist-based AI alerts |

1. Bobby by RockFlow: The Most Advanced AI Agent for Trade

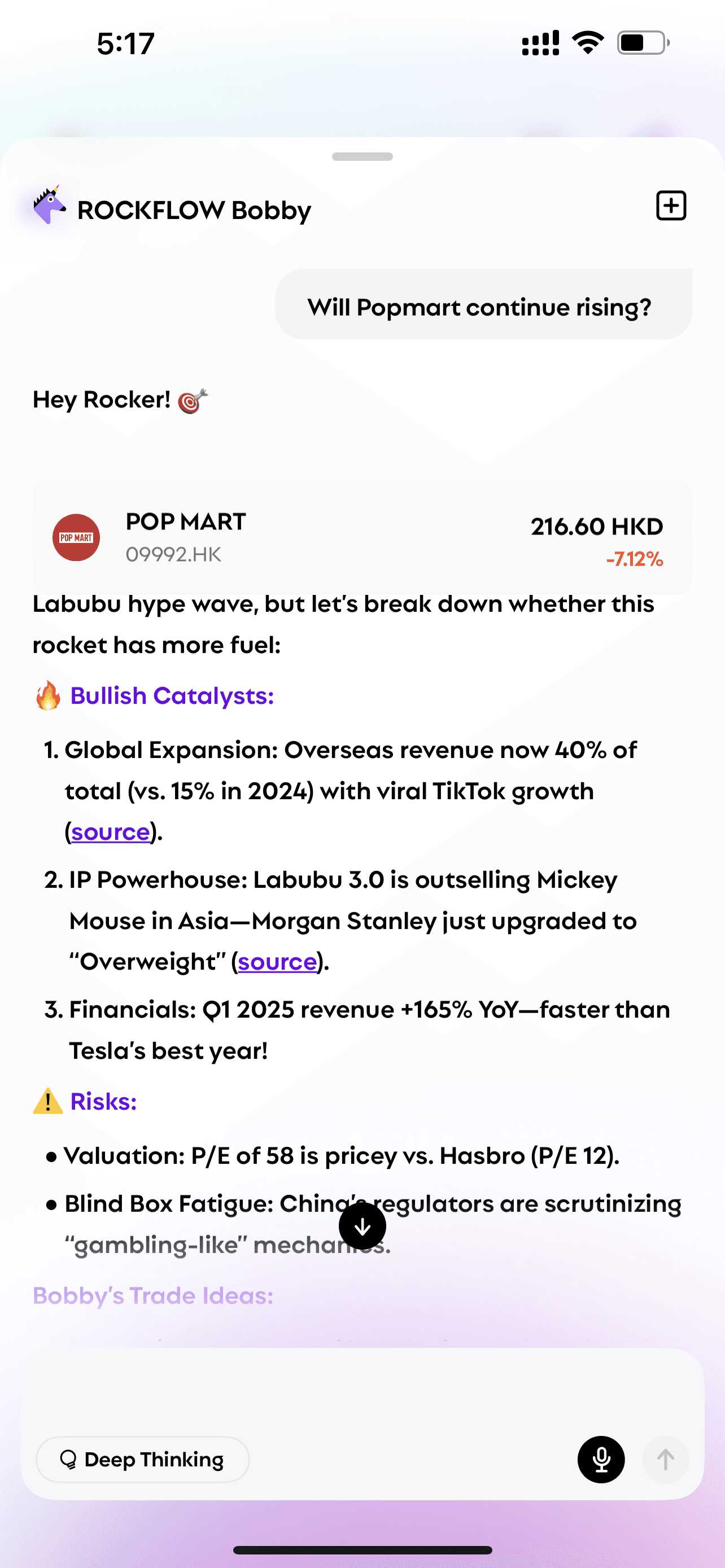

Bobby is more than an AI investing app — it's a full-stack AI agent for trade and quant trading assistant, built directly into the RockFlow platform.

What Makes Bobby Special

- Conversational Interface: Conversational Interface: Bobby chats like a friend, but thinks like a strategist. You can type things like:

- “Build me a dividend portfolio for the next 5 years.”

- “What should a tech-loving INFP invest in?”

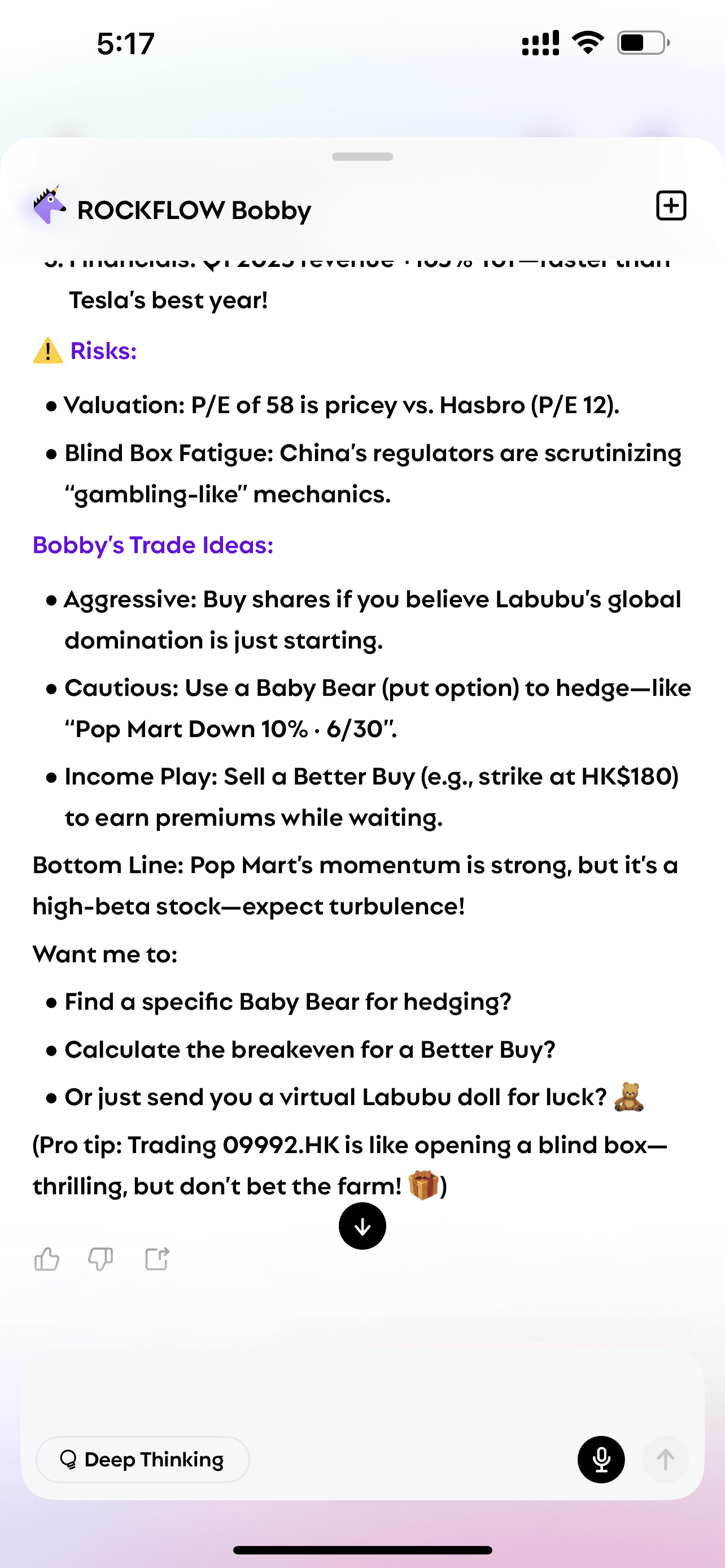

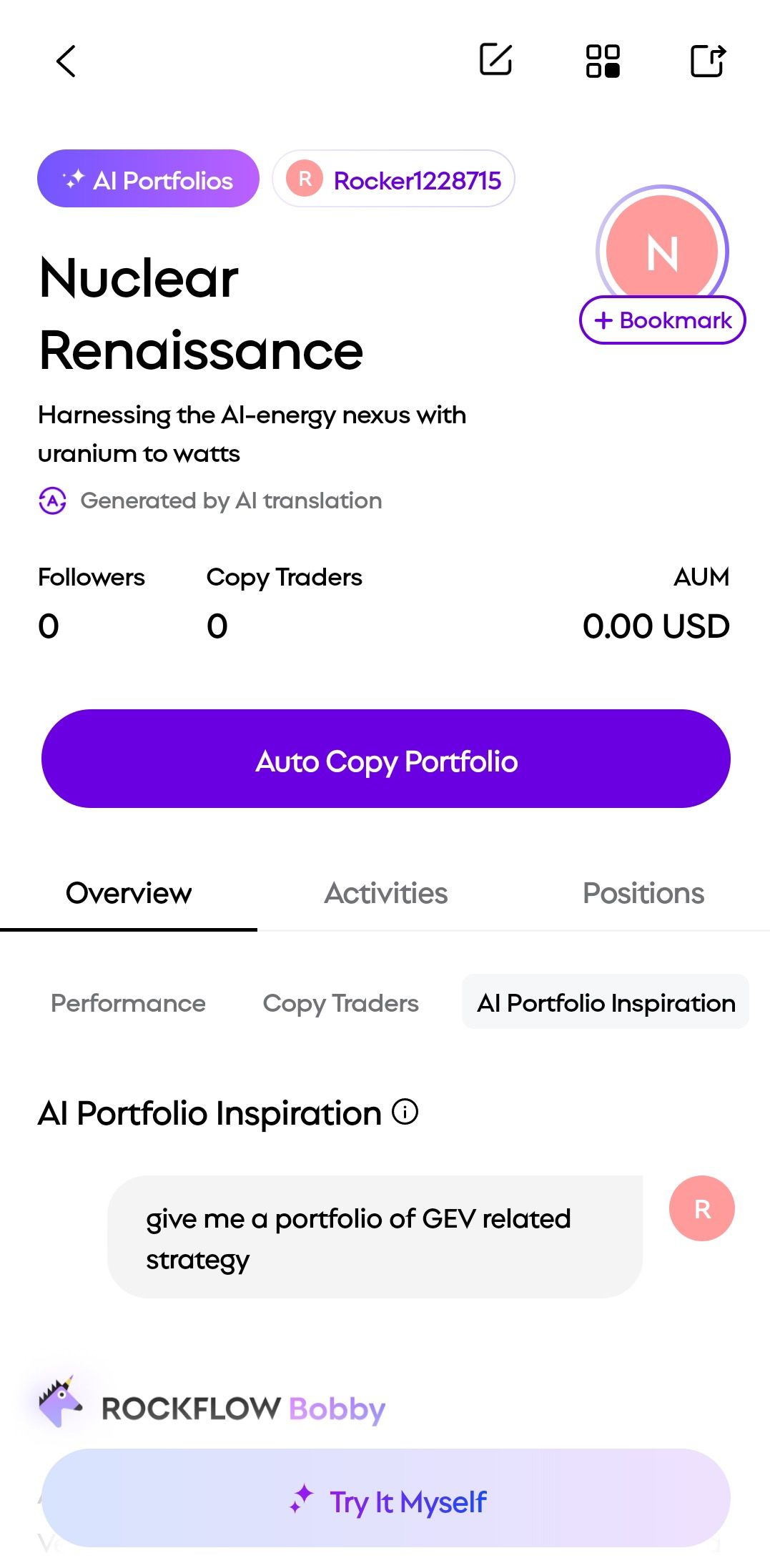

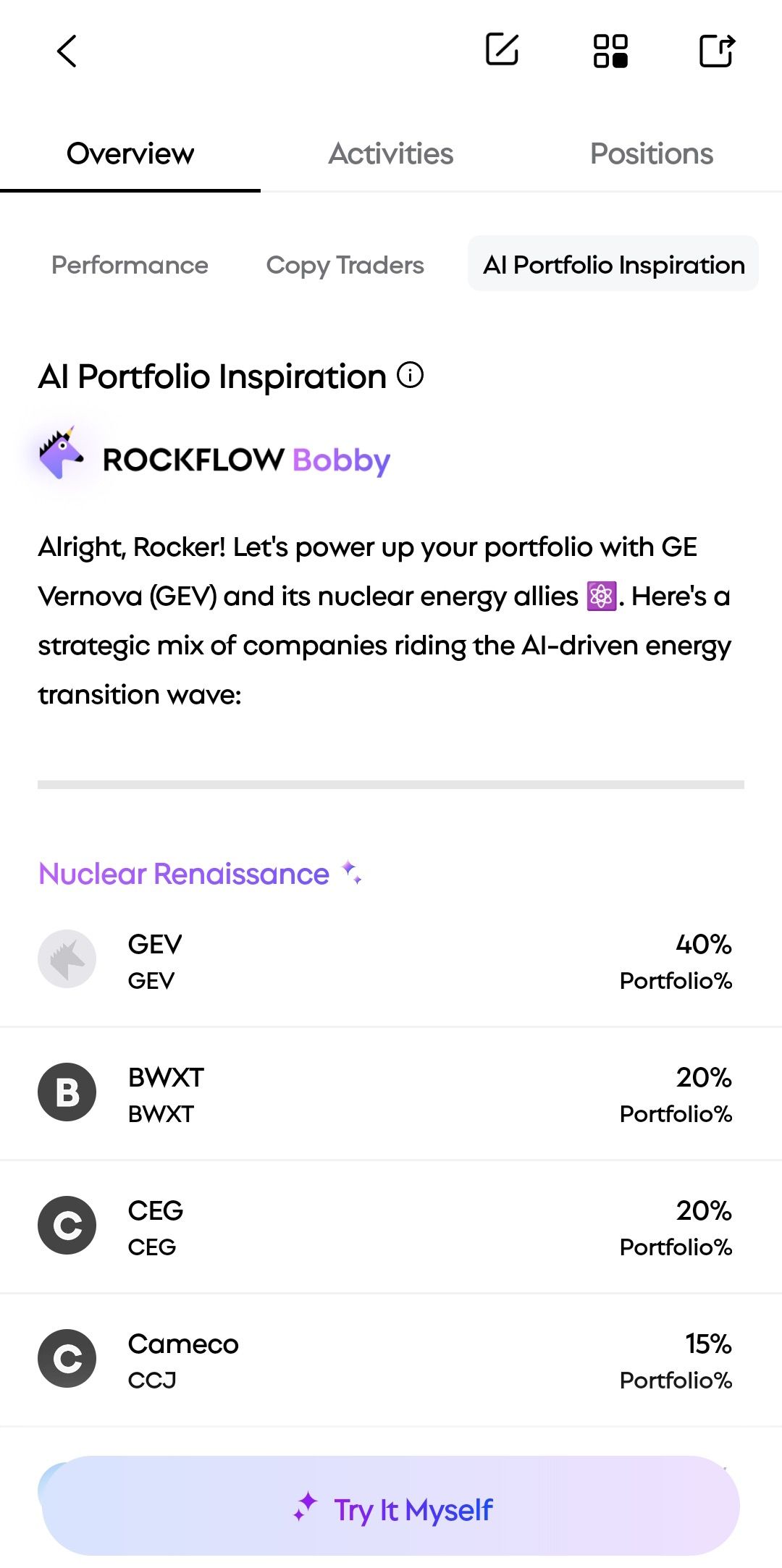

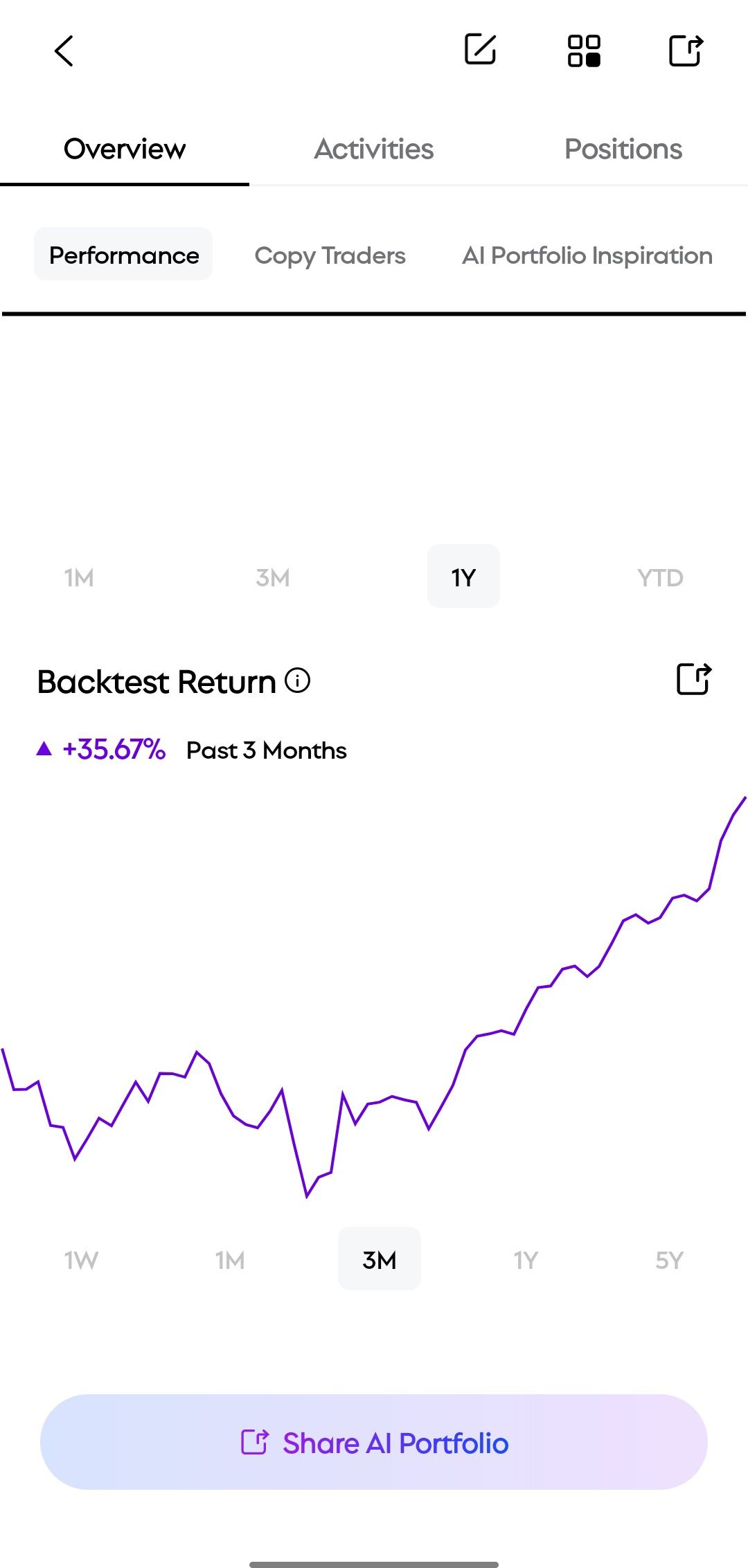

- AI Portfolio Maker: Takes your preferences, runs real-time screening, applies RockFlow’s proprietary quant models, and builds a complete strategy with:

- Asset allocation

- Backtests

- Risk-return profiles

- Live Trading Integration: Unlike most tools, Bobby doesn’t stop at suggestions. You can:

- Execute trades instantly

- Manage existing holdings

- Deploy options strategies

|  |

|---|

Real-Time Data Meets Human-Like Guidance

- 100+ live data streams (pricing, news, sentiment)

- Deep user profiling based on previous behavior

- RockFlow’s in-house quant team backing Bobby’s strategy engine

Strategy Square: Where Investing Meets Social

- Share your AI-generated portfolios with others

- Get followers

- Earn revenue if others mirror your strategies

|  |  |

|---|

In Our Tests

We tried asking Bobby to:

- Build a high-growth AI sector portfolio

- Analyze a user’s trade history and risk profile

- Adjust a strategy to market volatility in real time Bobby performed flawlessly — from generating backtests to letting us deploy the plan live with one tap.

Verdict: Best all-around AI invest tool for beginners, pros, and anyone wanting real-time execution, smart AI, and a human-like experience in one app.

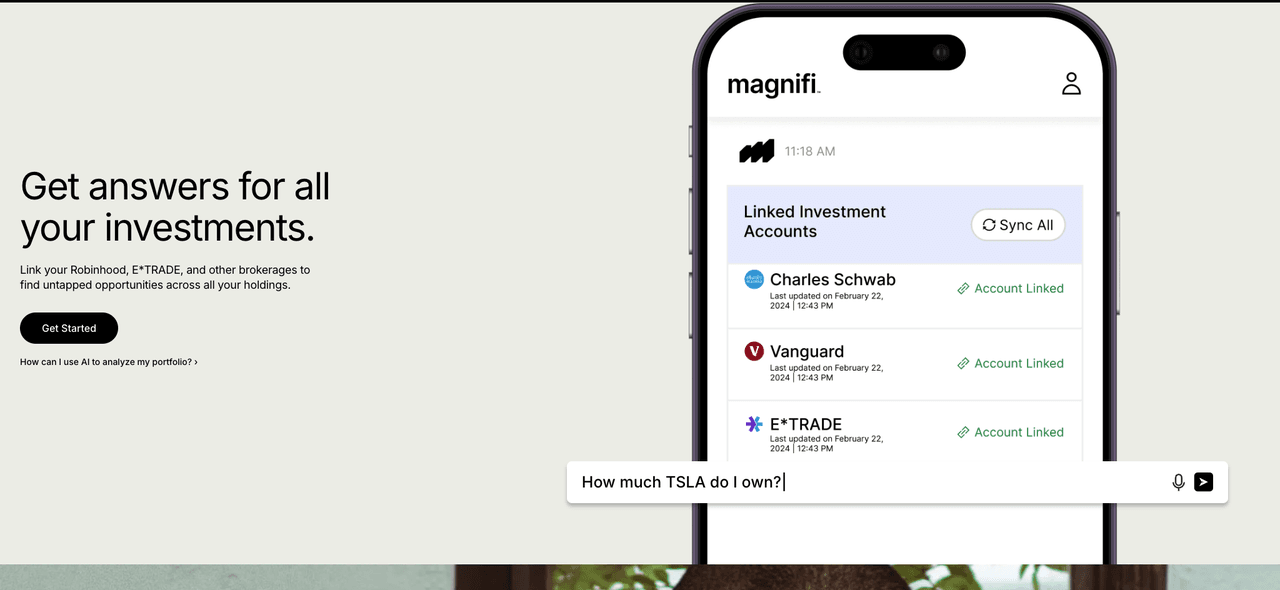

2. Magnifi: Clean UX, Strong Basics

Magnifi positions itself as a personal AI investing assistant. It links with external brokerage accounts like Robinhood or E*TRADE and provides insights on portfolio composition.

What It Does Well

- Natural language interface for questions like “Am I diversified?” or “Find me ETFs with low risk.”

- Easy visualizations and filtering by risk, sector, ESG, etc.

- Portfolio health scores

What It Lacks

- No in-app trading

- Doesn’t build full strategies

- Limited backtesting

Verdict: Great for beginners looking for a friendly AI investing app that explains their portfolio — but not for serious trading or execution.

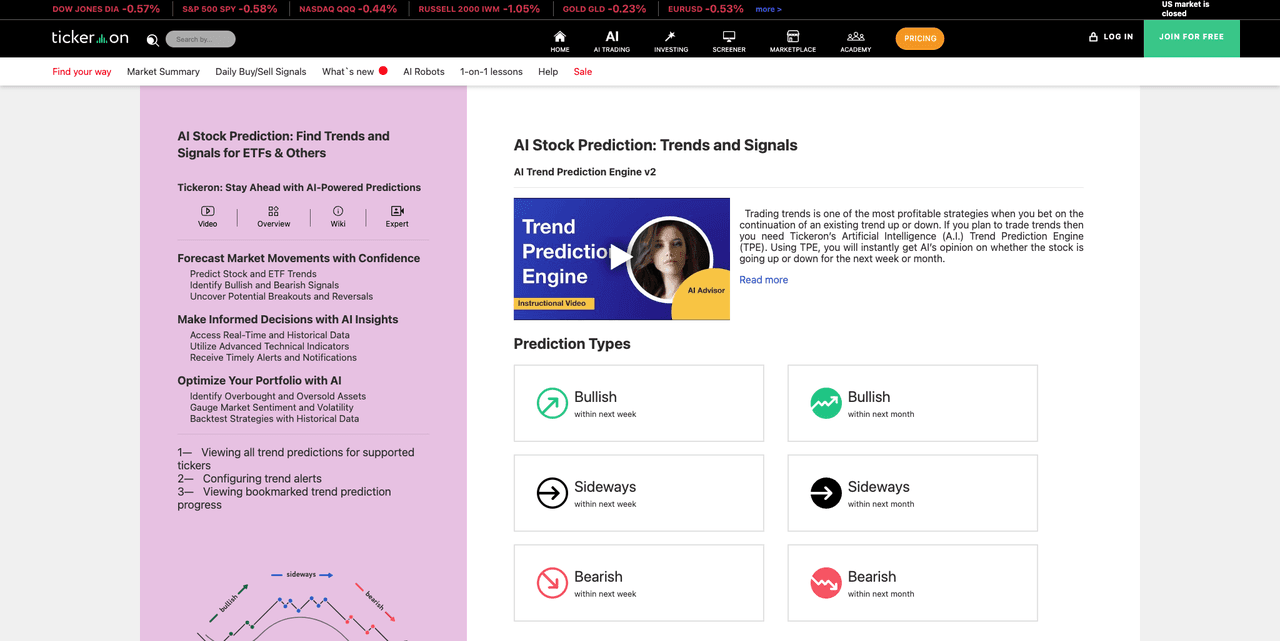

3. Tickeron: Quant Trading Without Code

Tickeron is less about casual use and more about quant trading. It offers AI pattern recognition, signal-based entry points, and rule-based bots.

What’s Inside

- Pre-built AI signals for swing trades

- Strategy builder using technical indicators

- Premium plans for auto-trading signals

Limitations

- Not very conversational

- Can overwhelm newer users with technical jargon

- No social features or portfolio management

Verdict: Ideal for experienced traders who want signals, backtests, and a rules-driven approach to AI trading.

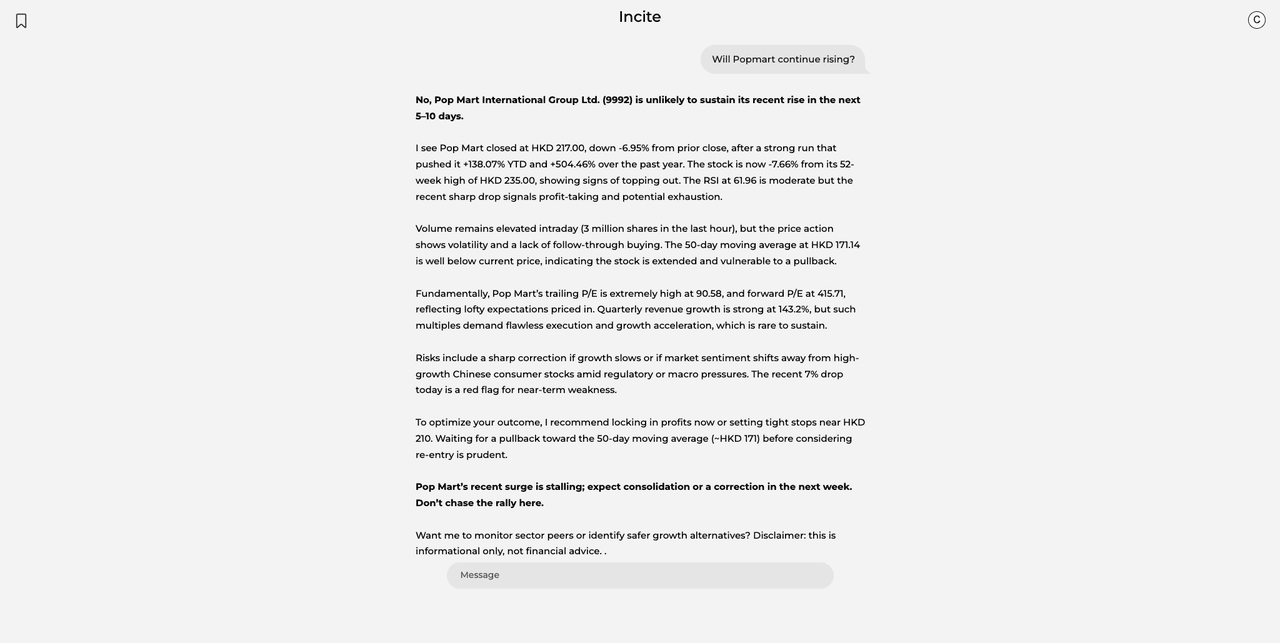

4. Incite AI: Chat-Based Investing Info

Incite is more of a conversational research bot. It uses natural language AI to answer stock questions like “What’s the outlook for Nvidia?”

Pros

- Great for educational purposes

- Helps compare companies quickly

- Good UI for visual learners

Cons

- Doesn’t learn from your preferences

- Can’t manage or build portfolios

- No trading or execution functions

Verdict: Like ChatGPT for finance questions. Great for research, not execution.

5. AlgosOne: No-Code Quant Trading Engine

AlgosOne gives you full freedom to build algorithmic strategies using conditions, rules, and triggers. It’s like Pine Script, but easier.

Strengths

- Strategy lab with no-code blocks

- Paper trading accounts

- Backtesting over multiple timeframes

Weaknesses

- Steep learning curve

- No personality or conversation

- Not ideal for everyday retail traders

Verdict: Ideal for pros and aspiring quants, but not beginner-friendly.

6. Koinly: Your AI-Powered Crypto Accountant

While not a trading bot, Koinly deserves mention as a crypto AI investing tool that helps automate tax reporting.

Features

- Wallet sync for major chains and exchanges

- Auto calculation of capital gains/losses

- Exportable tax reports for most countries

Limits

- Only for crypto

- Doesn’t advise or build strategies

Verdict: Excellent for crypto investors needing AI help at tax time, but not relevant to stock/ETF investors.

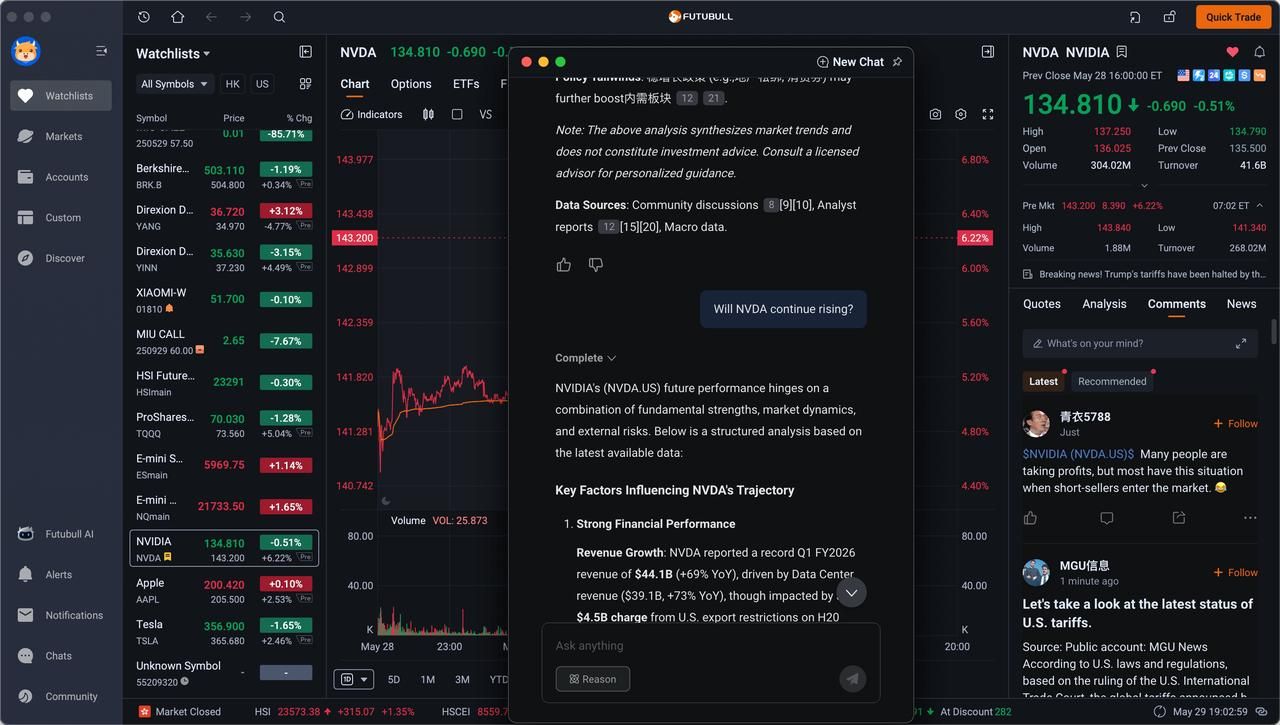

7. Futu (Moomoo): Trading App with Light AI Add-ons

Futu’s Moomoo app is a slick trading platform with some AI features.

Key AI Elements

- Smart watchlist alerts

- Basic AI-based portfolio suggestions

- News summarization bots

But its AI layer feels shallow — and doesn’t personalize beyond basic prompts.

Verdict: Strong for mobile stock trading, weak for those seeking an advanced AI agent for trade.

FAQ

Q1: What’s the best all-in-one AI investing app right now?

Bobby. It blends live trading, quant modeling, and AI conversation better than anything else we tested.

Q2: Can any of these tools execute trades for me?

Only Bobby offers end-to-end trading via chat and quant portfolio deployment.

Q3: Which tool is best for quant trading?

Tickeron or AlgosOne. Both focus on backtesting and rule-based strategy.

Q4: Do I need a RockFlow account to use Bobby?

Yes. Bobby is native to RockFlow and currently invite-only.

Q5: What AI app is best for crypto investors?

Koinly — for tax automation. None of these apps currently trade crypto.

Q6: Can Bobby help me pick ETFs, options, and single stocks?

Bobby doesn’t provide official stock recommendations, but it can inspire you with data-backed ideas based on real-time screening, market trends, and your personal interests. You’ll get smart prompts and portfolio examples to explore — the final decisions are always yours.

Q7: Does any AI tool let me publish strategies?

Bobby offers this via Strategy Square — including follower monetization.

Q8: What makes Bobby feel more “alive” than the rest?

It responds with metaphors, jokes, and context — like “Warren Buffett mode.” Smart and fun.

Want early access to Bobby? Apply here for beta and start building smart, personalized portfolios — the fun way.

Related Content