How to seize the epic opportunity of gold with a 40% surge in 2024?

RockFlow Shayne

April 18, 2025 · 13 min read

Highlight:

1)This round of gold bull market is driven by Geopolitical Risk Premium, central bank gold purchases, and monetary easing policies. The proportion of global central bank gold reserves has doubled in the past decade, reflecting structural doubts about the US dollar system. Frequent geopolitical conflicts have pushed up safe-haven demand, laying the foundation for long-term gold allocation logic.

2)Although the gold price has reached a new high, there is still significant room for upward movement: its actual purchasing power adjusted for inflation is only 40% of its peak in 1980; market indicators show that there is still a significant gap in the current holdings of gold ETFs compared to the peak period. Therefore, the central bank's gold purchase trend combined with the rigid support of mineral costs has clear upward movement space for gold and controllable downward pressure.

3)RockFlow research team believes that investors can flexibly layout through gold ETFs (low fees + high liquidity), gold mining stocks (leverage effect), etc. Gold has unique value in investment portfolios: volatility absorber (78% probability of positive return when stocks and bonds double kill), inflation transmitter (three-year hedging effectiveness 0.86), and it is also the ultimate payment medium in the transformation of the monetary system.

The most striking phenomenon in the global Financial Market in 2024 is that the price of gold continues to break through historical highs. The price of gold denominated in US dollars has risen by 40% in one year, soaring from $1,861 to $2,642, marking the strongest annual performance since the collapse of the Bretton Woods system in 1971.

RockFlow investment research team believes that this round of gold bull market is not a random short-term fluctuation, but the result of multiple structural factors driving together. This article will systematically analyze the operating logic of the gold market, analyze its core value as a strategic asset allocation, and provide you with specific strategies for investing in gold and investment research stock orders.

How to understand the value and price of gold?

The gold price denominated in US dollars is continuously breaking through historical highs, which is a continuation of the potential upward trend of gold and the long-term bull market. The strength of global gold prices also echoes and confirms this point. In recent weeks, the global gold price index of 14 currencies with equal weight has broken through new highs.

For the past few hundred years, gold has been a timeless choice for inflation reasons. It is difficult to say that gold itself has obvious "intrinsic value", but it does have some characteristics: scarcity, corrosion resistance, easy division, and no depreciation. Currently, the total global gold inventory exceeds 200,000 tons, which is negligible compared to the annual mining volume of 5,000 tons.

Even if there is a small mismatch between gold supply and demand in a given year, the increase in mining volume does not necessarily affect the gold price. For the gold price, what matters is what the current owners of 200,000 tons of inventory are doing.

Most owners believe that gold is a store of value. And it keeps pace with inflation, at least in the long run.

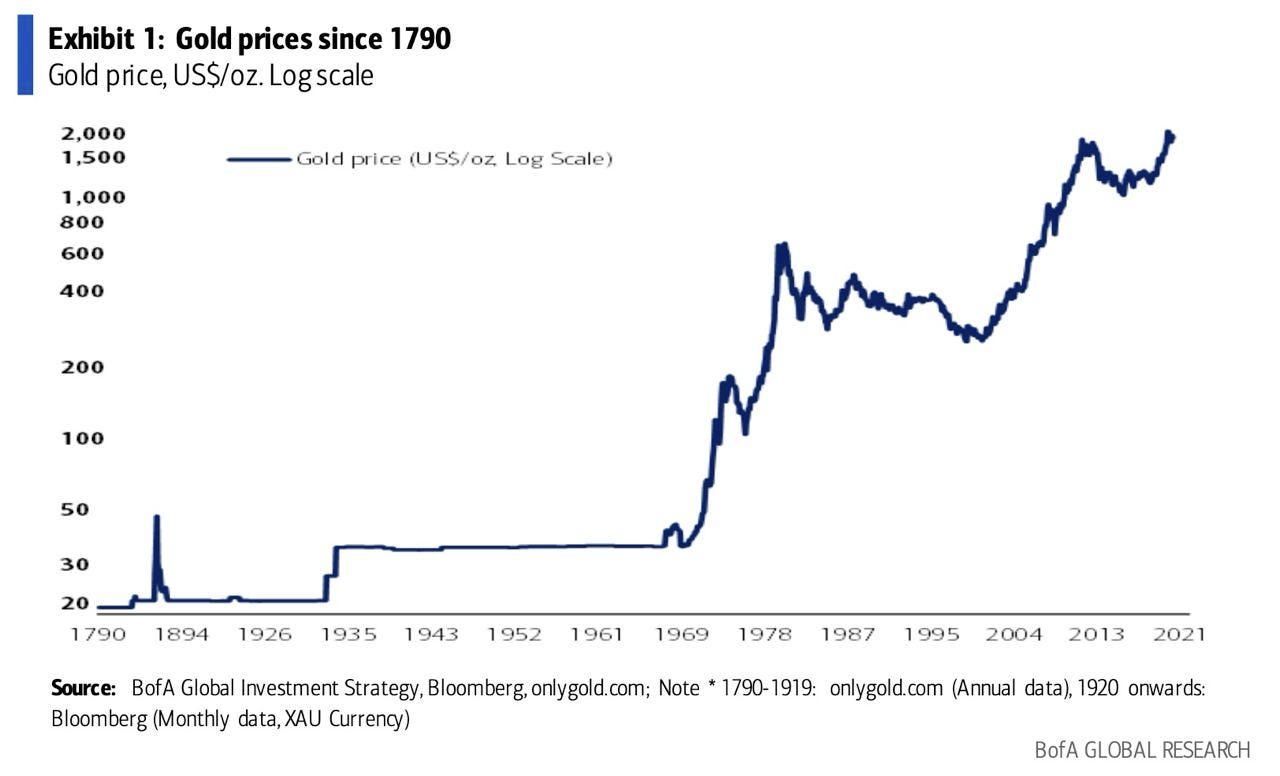

Here is a chart of gold prices in US dollars:

Before 1933, the price of gold was fixed at $20 per ounce, later at $35. In 1971, the US dollar was removed from the gold standard, and gold became a floating asset. Since 1971, the price of gold has risen sharply at a compound annual growth rate of 7.8% per year.

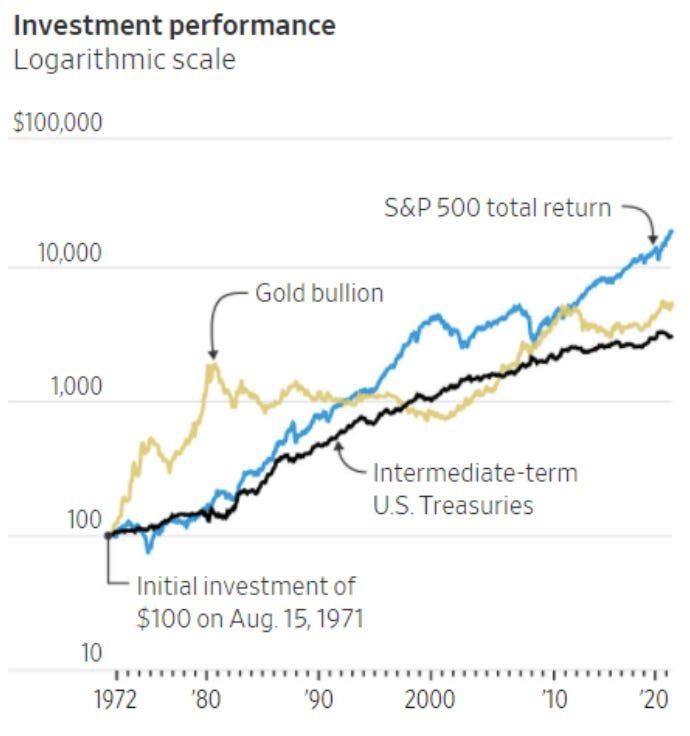

In fact, this does not mean that gold has become more valuable, it just reflects the continuous depreciation of the US dollar denominated in gold. The chart below shows that since the US left the Gold standard in 1971, gold has well protected capital from the impact of inflation - its long-term return rate has almost matched the performance of the S & P 500 index.

In short, gold can be seen as a "currency" that does not provide returns but can resist inflation in the long run. In the medium term, it continues to benefit from lower interest rates and higher inflation. It will also play a role in diversification and hedging during periods of extreme volatility.

Several driving factors for the rise in gold

In terms of factors driving gold's strength, several factors are at play, with the recent key factor being the surge in geopolitical risks.

Taking the recent tariff risk that caused a huge shock in the US stock market as an example, previously, the US tariff policy had stimulated a surge in COMEX gold inventory (people avoided the risk of physical gold Import Tariff by transferring gold from London to the US). Overall, as the geopolitical norms of the past few decades give way to a new era of international relations, geopolitical Risk Premium is being continuously factored into the gold price.

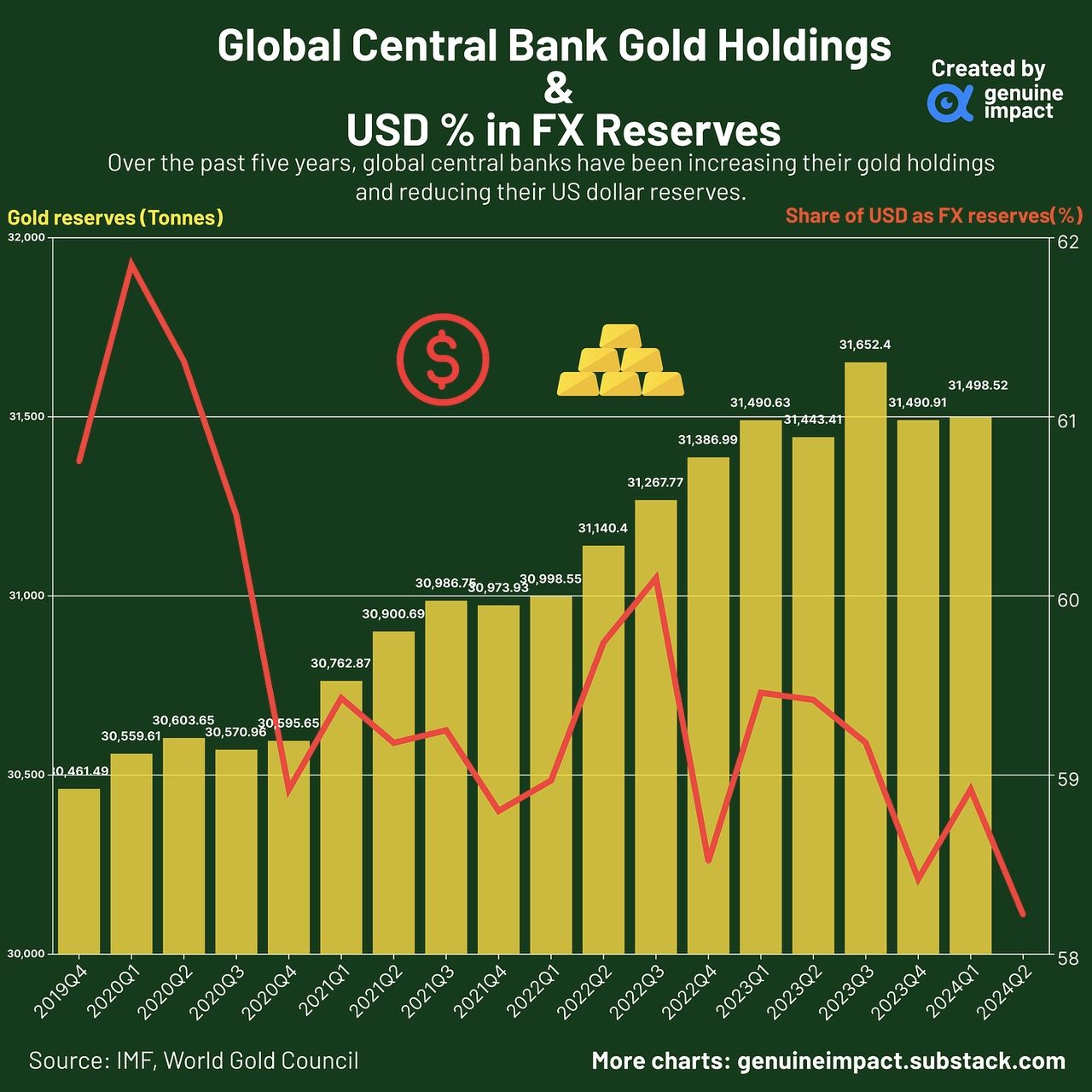

Another major driver driving the continued rise in gold prices is central bank reserve diversification (i.e. central bank purchases). Over the past decade, global central bank reserves have doubled their allocation to gold, which is likely to be a long-term trend given concerns about US fiscal sustainability and geopolitical (sanctions risk).

Central banks around the world have purchased a large amount of gold as part of their foreign exchange reserve diversification. Since 2020, the share of the US dollar in total foreign exchange reserves has decreased by 2.5%, due to various reasons such as the improvement of Financial Marekt and payment infrastructure in many countries, potential sanction risks, escalating geopolitical tensions, and fluctuations in US financial conditions.

Therefore, many central banks are increasingly interested in gold and hope to continue increasing its share in their foreign exchange reserves. The following chart illustrates how central banks' global gold reserves increase as the share of the US dollar in foreign exchange reserves decreases.

It is worth noting that central banks around the world are cautious participants in the gold market. Their purchases are usually not very active, but diversifying foreign exchange reserves takes years or even decades. Due to various considerations, central banks around the world have decided to further diversify their foreign exchange reserves, and there may be sustained buying in the gold market.

In addition, central banks around the world have provided additional impetus to the gold price through emergency interest rate cuts, expansion of M2 money supply, and loose monetary policy tendencies. These trends often last for many years and are difficult to suddenly reverse. In other words, the current main driving factors of the gold bull market may continue.

Is the rise in gold too strong?

With the continuous rise of gold prices, the most concerning question for investors is: 'Is it too late to enter the market now?'

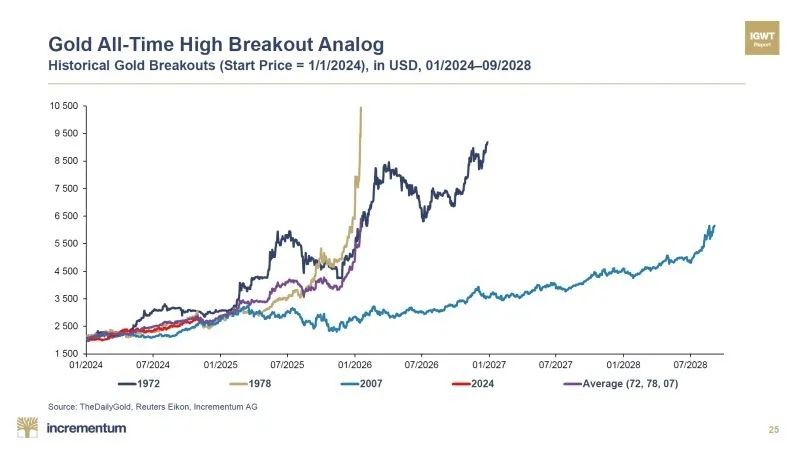

The RockFlow research team believes that these questions should only be asked when you have seen a truly strong upward trend in gold. The current increase is not the first time, as gold has experienced more sustained and violent rises in the past. The following chart summarizes the price performance of the gold bull market in four periods: 1972, 1978, 2007, and 2024. In comparison, the gold bull market in 2024 (red curve) is still in its early stages and has not yet passed the halfway point.

In addition, regarding the issue of entry timing, it may be better to break it down into the following to better address concerns:

First of all, is gold overvalued now? The answer is slightly overvalued, but the comprehensive valuation index is still far below the peak level in recent decades, so there is still room for growth.

Secondly, have all the potential bulls on gold entered the market? Data shows that ETF funds related to gold are still flowing out, and the allocation of retail investors is still very low, so there is still room for growth.

Also, is the monetary easing policy turning? Obviously not, key cyclical and thematic drivers show no signs of weakening; therefore, gold still has room to rise.

Overall, there is currently nothing that can stop the further development of the long-term bull market in gold.

How to invest in gold easily and simply?

There are four main ways to obtain gold exposure: physical assets, ETFs, futures, and gold mining stocks. The RockFlow research team will discuss these options one by one.

Physical gold (gold bars or gold nuggets)

Historically, the most popular way to obtain gold was to purchase physical gold bars or nuggets. However, the problem with gold bars is storage costs and security risks. The storage cost of third-party facilities is about 0.5% per year. If stored at home, there is a risk of theft and insurance costs are expensive.

In addition, physical gold is also at risk of being requisitioned. For example, in the 1940s, the Nazi government looted gold from individuals and banks in the occupied countries. The same was true during the Nationalist government in the 1940s, when it forced holders of precious metals to exchange it for legal tender.

Gold ETF

One of the simplest ways to gain exposure to gold is to buy a gold ETF. It is a financial product based on gold assets that tracks the price of gold and can achieve similar returns to gold, while trading is very convenient.

The operating principle of gold ETF is: consignment of physical gold by large gold producers to fund companies, and then the fund company relies on this physical gold to publicly publish fund shares on the exchange and sell them to various investors. Commercial banks act as fund custodians and physical custodians, and investors can redeem them freely during the fund's existence.

Compared to physical gold, the advantage of gold ETFs lies in their low transaction costs. Investors who purchase gold ETFs can waive the storage fees, storage fees, and insurance fees for gold, and only need to pay a management fee of 0.3% to 0.4%. Compared to the average fees of 2% to 3% for other gold investment channels, the advantages are very prominent. In addition, gold ETFs also have the advantages of safe storage and strong liquidity.

The following four low-cost US gold ETFs can meet the different needs of investors:

GLD: Established in November 2004, it is the oldest and largest gold ETF in the US, so its liquidity is quite good, the bid-ask spread is very small, and its options market is more active than any other traditional gold fund. The only downside is that the fund has a relatively high expense ratio of 0.40%.

IAU: The second largest gold ETF in US assets, established in early 2005, represents the equity of physical gold like GLD. Its liquidity is not as good as GLD, and the bid-ask spread is not small, making it not an ideal choice for short-term trading. However, IAU has a lower Cost Of Carry ratio of 0.25%, making it suitable for long-term holding.

GDX: In addition to investing in physical gold ETFs, gold mining stock ETFs are also an option. GDX holds stocks of about 50 gold miners and can track the stock performance of gold producers. However, it should be noted that the price volatility of gold stocks is higher than that of gold, so GDX is more suitable for holding during the gold bull market and short-term trading. Its expense ratio is slightly higher, at 0.51%.

GDXJ: Among gold miners, junior miners engaged in gold exploration have greater risks than traditional miners, but also greater upward potential. If you are willing to pursue higher returns and take more risks, GDXJ is very suitable for you. GDXJ invests in nearly 100 gold mining companies, which is a good way to diversify risks. Its fee rate is also slightly higher, at 0.52%.

Gold futures

Gold futures are usually suitable for gold producers themselves or large financial institutions. For example, if a producer wants to lock in future prices, it can sell forward futures and profit from the difference between that price and the spot price at maturity.

Futures trading allows for greater leverage, but there is a risk of additional margin. It is not very suitable for ordinary investors.

Gold mining stocks

Another indirect way to gain exposure to gold is to buy gold mining stocks - companies that mine metals from underground and sell them. The stock price performance of gold mining stocks is often several times that of gold prices. If the gold price rises, the operating leverage will ensure that the profits of gold mining companies grow faster. Some of them also offer annual dividends. Junior miners engaged in gold exploration have greater risks than traditional miners, but also greater upward potential, suitable for investors who pursue higher returns and are willing to take more risks.

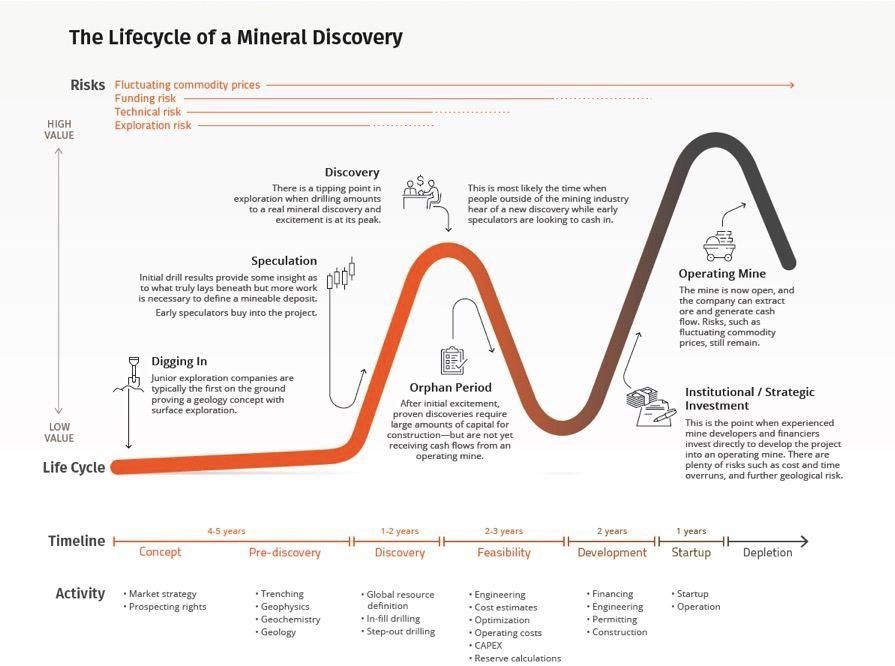

When examining gold mining stocks, investors need to understand the "Lassonde curve". This curve illustrates the journey that junior miners may go through in various stages of development from exploration to production. When a new mine is discovered, the stock price usually rises; when capital is used for actual construction, the stock price falls; when the mine is nearing completion, the stock price rises again.

Unlike the price of gold, the performance of gold mining stocks is not continuously rising. Especially in 2021, the performance of gold mining stocks is contrary to the price of gold, but with the current situation of continuous strengthening of gold prices and increasing geopolitical risks, the growth of gold mining stocks is worth looking forward to.

In addition, from the perspective of valuation, the current discount of gold mining stocks is the largest since the Internet bubble. Therefore, this sector can serve as an alternative hedging or risk diversification tool to cope with the volatile market of the US stock market. At the same time, if the gold price rises further, this sector will also benefit. The RockFlow investment research team believes that this is a combination of defensive and upward potential.

Conclusion

The RockFlow research team believes that in the current era of a century of changes in the fiat currency system, gold is returning to the center stage of the financial system from a marginal asset. Its value storage function beyond sovereign credit, natural properties of resisting currency depreciation, and ultimate payment ability in extreme risks constitute irreplaceable strategic allocation value.

For rational investors, gold is not only a safe haven against storms, but also an important means of participating in global wealth redistribution. In the upcoming restructuring of the monetary order, gold will become a stable wealth anchor.